KeyBank proceeded the many years-a lot of time refuge out-of promoting Black colored and you may lower-income homeownership during the 2022, a diagnosis quite latest federal studies toward financial lending reveals.

Black consumers made-up merely dos.6% of your own Cleveland-founded bank’s home pick financial financing in the 2022, off off step 3% the year previous. KeyBank could have been move straight back of support Black colored homeownership annually since the 2018, whenever six.5% of their house purchase money decided to go to a black borrower.

KeyBank produced 19.2% of its home purchase loans on the seasons to reasonable- and you will reasonable-earnings (LMI) borrowers, off off 19.7% during the 2021. So it small however, extreme one to-seasons decline understates KeyBank’s lengthened-name results to have non-wealthy family members seeking to get a property to reside: In the 2018 more 38% of such KeyBank loans visited an enthusiastic LMI borrower.

Each other study items research also uglier when compared to most other most readily useful lenders, exactly who made more than 29% of the 2022 get mortgages so you can LMI borrowers and you will on the 7% of these to help you Black individuals.

KeyBank’s regular withdrawal away from Black colored and low-rich individuals seeking purchase a property works restrict on the spirit of arrangement they made out of community leaders while you are looking to approval to own a great merger for the 2016, while the research we penned just last year documented. In identical months away from 2018 so you’re able to 2022 if the bank is moving on the financial organization so you’re able to richer, Whiter groups, their executives spotted complement so you’re able to hike stockholder dividends with the new winnings on merger tied to the since-damaged claims.

All of our 2022 report detail by detail KeyBank’s serious failure in the helping lower and you will moderate-money (LMI) and you will Black colored consumers in groups they pledged to greatly help. KeyBank inside the 2016 signed a residential district Pros Contract (CBA) to the National Community Reinvestment Coalition (NCRC) and various society teams representing those individuals same borrowers’ interests along side country. The offer try instrumental from inside the fulfilling judge and you may regulatory criteria inside the KeyBank’s effective merger with First Niagara Bank.

Of the 2021, KeyBank has been around since brand new poor significant mortgage lender having Black colored individuals. NCRC cut connections having KeyBank just after training the fresh bank’s abandonment off Black and you may LMI individuals. We notified authorities that bank would be to receive an excellent downgraded Area Reinvestment Operate get . Even though the lending company first issued mistaken and you may wrong solutions asserting it hadn’t over just what wide variety let you know, it was later on compelled to commission a racial equity audit shortly after investors used stress more our very own findings.

The newest 2018-2021 pattern you to definitely prompted NCRC’s . Even after claiming getting enhanced financing so you’re able to LMI individuals while the a share of the lending, KeyBank have failed to generate tall strides. The brand new study along with subsequent weaken KeyBank’s social twist responding so you can NCRC’s findings.

NCRC’s past declaration covering 2018-2021 already decorated a great damning image of KeyBank’s strategies post-merger. The lending company systematically and blatantly scale back on financing to your really individuals they vowed to aid and you can charts of their lending activities displayed the bank methodically eliminated Black teams. I next found that KeyBank don’t render loans similarly so you loans in Broomtown can Black-and-white individuals, and you may substantially reduce its express away from credit so you’re able to LMI individuals despite previous pledges. It is now obvious that the same fashion we had been ready to spot from the bank for the last year’s declaration went on using 2022 as well.

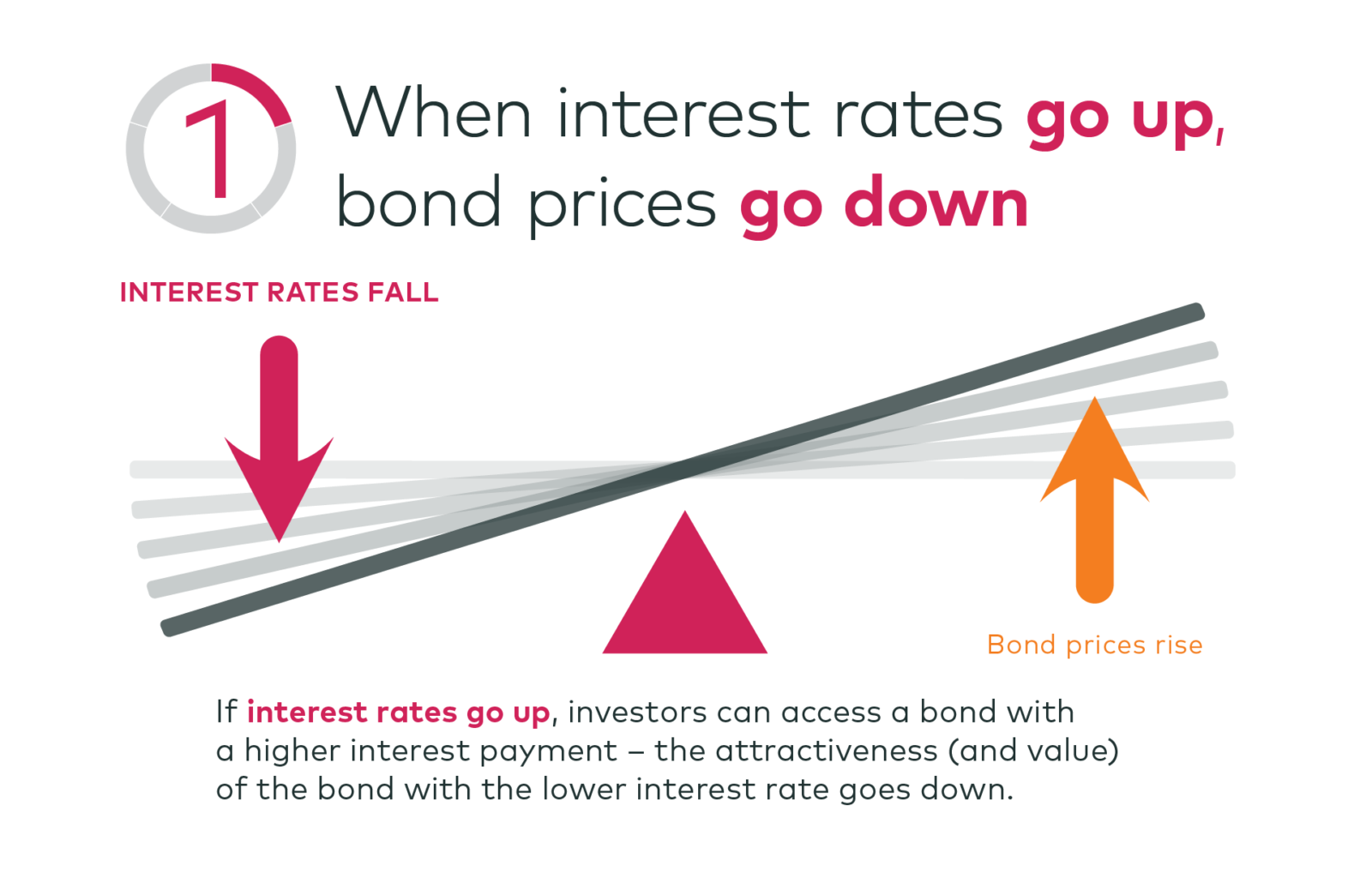

The newest numbers having 2022 need specific perspective. A year ago is a time period of over the top change in the mortgage business, once the rates spiked on the higher point in 2 decades. Changes in rates out of 2021 in order to 2022 affected all the financial lenders across the country. The fresh usually low interest of 2020 and 2021, and therefore watched the fresh new 31-12 months repaired rates mortgage dipping so you’re able to dos.65%, will give answer to a peak of over 7% by the end out-of 2022.

It prolonged age of low rates, followed by an increase toward higher costs from inside the more 20 many years, drastically reshaped the overall home loan opportunities. So it’s not surprising you to KeyBank’s complete home loan company shrank drastically from inside the 2021 a representation out-of business-greater fashion. KeyBank made 29,895 complete mortgage loans of all sorts during the 2022, down 35% regarding 2021.

But which shed-from in total mortgage lending is usually motivated by the evaporation off refinance and cash-away refinance financing borrowing from the bank that’s tied to a house, however for the secret inflection point in the newest monetary better being regarding a household who’s got in earlier times hired. KeyBank produced lower than you to definitely-3rd as much eg non-get mortgages just last year whilst had when you look at the 2021, dropping from more twenty seven,000 to help you lower than nine,000.

Meanwhile, household get lending barely dipped. When you look at the 2022, KeyBank made nine,900 household get funds, a somewhat modest step 3.6% miss in the 10,265 such financing it made in 2021.

House purchase fund are definitely the number one signal off an excellent lender’s efficiency with the closing the newest racial homeownership and you will money divides, because they portray home deciding to make the leap regarding the riches-deteriorating facts from renting into wealth-building promise out of having.

Even with handling to keep the overall volume of family get financing seemingly steady in the rate of interest turmoil away from 2022, KeyBank continued turning off Black colored borrowers. Only dos.6% of their family get financing went along to a black colored debtor last 12 months off regarding past year’s step three% display. KeyBank provides failed to boost the home pick financing to Black colored homeowners. Factoring lso are-fi funds back into does not opposite you to definitely pattern.

KeyBank’s a reaction to past year’s declaration was to tout a great 24% increase in credit in order to African-Us citizens, a statistic that sound impressive it is meaningless when believed contrary to the overall show of the money. The brand new 2022 number still place KeyBank towards the bottom of the major 50 loan providers for the loans in order to Black colored consumers, having only 2.5% of 30,895 finance going to a black colored debtor. The financial institution including rated improperly various other minority financing kinds: second-terrible to possess Latina borrowers, third-poor getting minority-bulk system credit as well as financing inside the LMI census tracts, and fourth-terrible getting minority borrower financing complete.

An examination of KeyBank’s passion within top locations corroborates this type of conclusions. In many locations, KeyBank ranking from the or nearby the base in those metro parts when it comes to lending to Black and you may LMI homebuyers compared into top ten banks with respect to 2022 originations in one region. The show selections of average to help you downright worst, failing woefully to prioritize financial support on these crucial class once more, even after pledging to achieve this written down 7 in years past when authorities were offered whether to agree a great merger you to definitely generated KeyBank’s insiders wealthier. The numbers make sure KeyBank has never prioritized capital during the LMI individuals, even after their explicit commitment to carry out that.

The details out-of 2022 only sharpens the image out of KeyBank’s unfulfilled obligations. Its inability so you’re able to effectively suffice Black colored and you will LMI borrowers isnt merely a violation off faith and in addition a significant barrier to help you community invention. Talking about maybe not mere analytics; they represent lifestyle and you will groups one are nevertheless underserved. Plus they subsequent discredit the bank’s personal twist of its worst carry out.

Categories

Submit a Comment